Luxembourg Law implementing the EU Directive 2018/822 voted on March 21,2020

TAX NEWS (25 March 2020)

On Saturday 21 March 2020, the Luxembourg Parliament held a session where the draft bill implementing the EU Directive 2018/822 (also known as “DAC6”) was voted. The State Council has granted an exemption for the second vote. Therefore the published text (the “Law”) will include all the amendments highlighted in our Tax News of February 2020 [https://www.avocats-sagnard.com/tax-news-february-2020/].

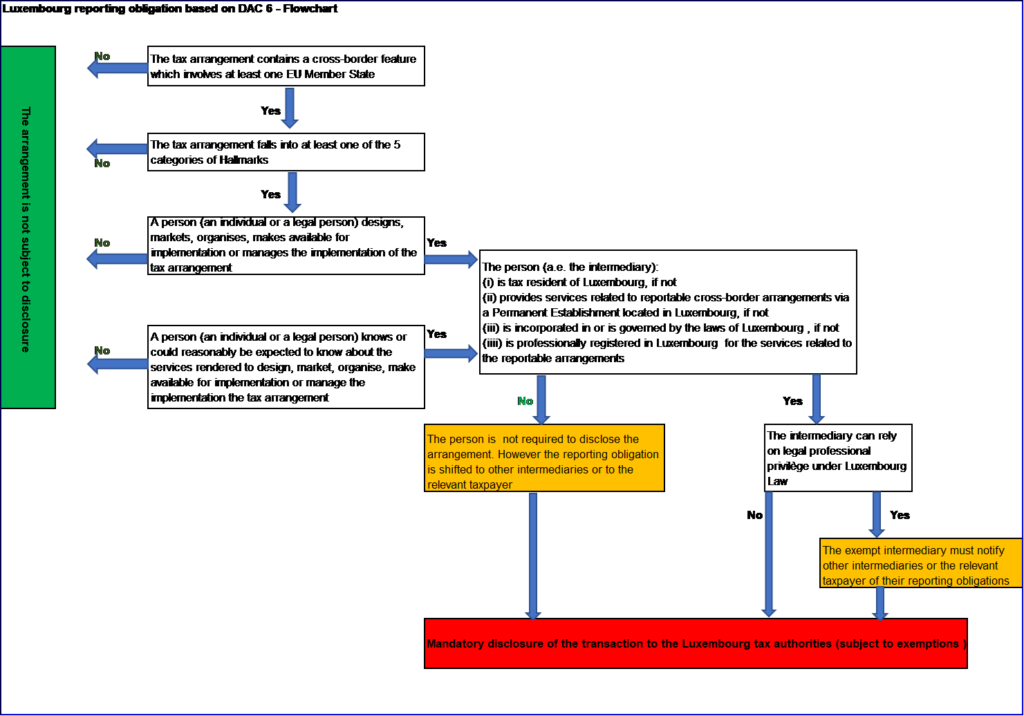

In a nutshell, DAC 6 requires intermediaries (and in some circumstances the taxpayers) to disclose certain information on cross-border arrangements featuring at least one indicator of aggressive tax planning (or “Hallmarks”). The objective is to reach a greater transparency among the EU Member States and ultimately to prevent Base Erosion and Profit Shifting.

The 5 categories of Hallmarks described in the Directive 2018/822 have been transposed as such in the Law. The main features of the Law, as they will be applicable as from July 1, 2020 are summarized below:

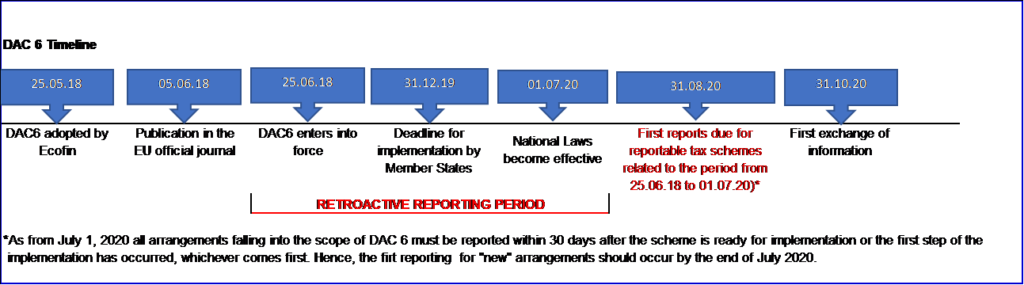

What is the timing of the reporting?

Intermediaries (exempt intermediaries excluded) and taxpayers falling under the scope of DAC6 are required to:

- disclose information regarding reportable tax arrangements to the Luxemburg tax authorities within 30 days after the implementation of the transactions, or if the first step of the implementation has occurred, whichever comes first.

- provide quarterly updates on the arrangements qualifying as “marketable” (i.e. “ready to use” cross-border arrangements which do not require substantial customization before being implemented or being made available for implementation).

- Report annually in the tax return the arrangement previously reported if the construction is still applicable.

Intermediaries covered by professional secrecy are exempt, but they must notify the other intermediaries or the taxpayer of their filing obligations within 10 days after the implementation of the transactions, or if the first step of the implementation has occurred, whichever comes first.

Reportable transactions implemented between 25 June 2018 and July 1, 2020 must be reported by August 31, 2020 at the latest.

Who is responsible for the reporting?

In principle, the obligation falls on non-exempt intermediaries (individuals and legal persons) or on the taxpayers.

Where several intermediaries are concerned, each of them remains personally responsible for the reporting unless he can demonstrate that the information has been disclosed by another intermediary.

The taxpayer may authorize an exempt intermediary to submit the information to the Luxembourg tax authorities on his behalf.

What information to disclose?

- Identity of the intermediaries and of the relevant taxpayers

- Details of the hallmark(s) to be reported

- A brief description of the tax scheme

- Date of the first step of the implementation

- Legal provisions forming the basis of the arrangement

- EU Member States involved in the arrangement and any Member State likely to be concerned by the arrangement

- Value of the arrangement

- Identity of any other person likely to be affected by the arrangement.

What are the penalties?

A penalty of EUR 250,000 will apply for failure to report, late reporting, inaccurate reporting, incomplete reporting, failure to notify the other (non-exempt) intermediaries or the taxpayer of the shift of the reporting obligations on them

How can we help?

Whether you are a taxpayer or an intermediary on whom the reporting obligation falls, we can help you become DAC6 compliant right from July 1, 2020.

We have the professional skills to help you:

- identify the arrangements which fall within the scope of DAC6

- gather all the relevant documentation related to such arrangements, starting with those implemented since June 2018

- propose tailormade solutions for your business considering your size, your structure and the number of cross-border arrangements involved.

Should you have further questions please contact us https://www.avocats-sagnard.com/contact-us/.

Phone (Lux): +352 26 20 37 51

SAGNARD & ASSOCIES